Medigap Benefits for Dummies

Wiki Article

Medigap Fundamentals Explained

Table of ContentsThe 8-Minute Rule for How Does Medigap WorksWhat Does How Does Medigap Works Mean?The Best Strategy To Use For How Does Medigap Works4 Simple Techniques For MedigapWhat Does How Does Medigap Works Mean?

You will need to talk to a qualified Medicare representative for rates as well as accessibility. It is extremely suggested that you acquire a Medigap plan throughout your six-month Medigap open enrollment duration which begins the month you transform 65 and also are signed up in Medicare Part B (Medical Insurance Policy) - How does Medigap works. During that time, you can buy any type of Medigap plan marketed in your state, even if you have pre-existing problems.You may have to get a much more pricey plan later, or you might not be able to buy a Medigap policy whatsoever. There is no assurance an insurance provider will certainly offer you Medigap if you make an application for protection outside your open enrollment period. As soon as you have actually chosen which Medigap strategy fulfills your requirements, it's time to find out which insurer sell Medigap plans in your state.

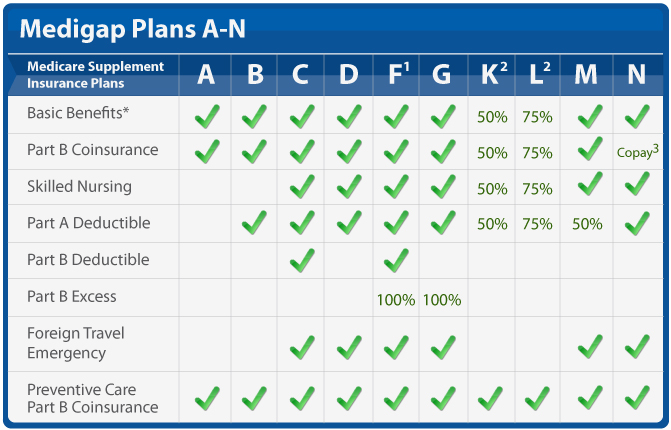

Called Medicare Supplement, Medigap insurance coverage plans help load in the "voids" in Original Medicare by covering a part of the out-of-pocket expenses Over after Medicare Component A as well as B coverage. The specific insurance coverages depend upon the kind of plan that is acquired and which specify you stay in.

In general, Medigap insurance firms deal with Initial Medicare and each strategy kind supplies the same benefits, also throughout insurance companies. In many states, Medicare supplement strategies are named A via N. Tabulation, Expand, Collapse When exploring Medigap intends, you might likewise review about Medicare Advantage plans additionally called Medicare Component C.

See This Report about Medigap Benefits

Medicare supplement insurance policy, on the other hand, is an addition to your existing Initial Medicare strategy. Medigap policies just can be combined with Original Medicare and also not Medicare Benefit. Medigap plans are standardized and recognized by letters, and also have to comply with government and also state standards. Usual Medigap insurance coverages include: This is an out-of-pocket expenditure that individuals have to pay each time they receive healthcare or a clinical item, such as a prescription.With Component B, Medicare normally pays 80% and also the patient pays 20%. With Component A, there's a deductible that uses to each advantage duration for inpatient treatment in a hospital setup.

9 Easy Facts About How Does Medigap Works Explained

, private-duty nursing, or long-term treatment.

Medigap plans can help you reduce your out-of-pocket healthcare expenses so you can get budget friendly treatment for thorough health care throughout your retirement years. Medicare supplement strategies might not be right for each situation, yet understanding your choices will certainly help you decide whether this kind of insurance coverage could assist you manage medical care costs.

Journalist Philip Moeller is below to provide the solutions you require on aging and also retired life. His regular column, "Ask Phil," aims to help older Americans and their families by addressing their wellness treatment and also financial inquiries.

Some Known Incorrect Statements About How Does Medigap Works

The largest void is that Component B of Medicare pays only 80 percent of covered expenses. More than likely, more individuals would buy Medigap plans if they could afford the regular monthly premiums. Virtually two-thirds of Medicare enrollees have basic Medicare, with about 35 percent of enrollees instead selecting Medicare Advantage plans.

Unlike various other private Medicare insurance policy strategies, Medigap strategies are controlled by the states. And also while the particular protection in the 11 different kinds of plans are dictated by federal guidelines, the costs as well as schedule of the plans depend upon state regulations. Federal guidelines do give guaranteed concern civil liberties for Medigap purchasers when they are new to Medicare and in some conditions when they change between Medicare Advantage and also fundamental Medicare.

Nevertheless, once the six-month period of federally mandated civil liberties has passed, state policies take over establishing the legal rights individuals have if they wish to purchase brand-new Medigap strategies. Here, the Kaiser table of state-by-state regulations is important. It must be a compulsory quit for any individual thinking of the duty of Medigap in their Medicare plans.

What Does How Does Medigap Works Do?

I have not seen hard information on such conversion experiences, and also regularly tell readers to examine the market for brand-new plans in their state prior to they switch into or out of a Medigap strategy throughout open enrollment. Nonetheless, I presume that worry of a possible issue makes numerous Medigap insurance holders immune to change.A Medicare Select plan is a Medicare Supplement plan (Strategy A via N) that conditions the repayment of advantages, in whole or partially, on using network service providers. Network companies are suppliers of healthcare which have actually entered into a created arrangement with an insurance provider to give benefits under a Medicare Select plan.

Report this wiki page